Your source to global events that impact the economic recovery and other musings for the not so faint-hearted.

Sunday, July 17, 2011

Private Sector Participation in Greek Tragedy Crucial for Successful Outcome

by Grant de Graf

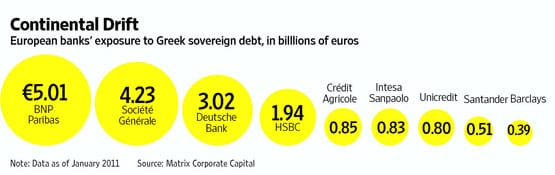

The forthcoming European summit, set to facilitate private sector participation in the Greek rescue is important. Failure to include bondholders in coordinating events, would make the bailout in essence, the provision of a rescue plan for investors, rather than a lifeline for Greece. The bailout needs funding that should be directed towards the revival of Greece's economy. It should not be a vehicle to buttress the pockets of investor's who are looking to call on a perceived surety that was provided by the ECB. In the long term this will be in the best interests of bondholders, as surely they are looking for a long term solution in which full capital can be redeemed - not a local anesthetic that provides temporary relief and doesn't deal with the cause.

The ECB's opposition to the government's plans for private-sector involvement is preposterous. Ostensibly, ECB officials fear a declaration of Greek default, even of a narrow kind, could cause a wider conflagration in financial markets. The reality is that the market has already factored in the bailout as a quasi-default. Clearly, there are other interests at play, and officials need to be weary of those at the ECB who toe this line.

Subscribe to:

Comments (Atom)