Your source to global events that impact the economic recovery and other musings for the not so faint-hearted.

Saturday, July 30, 2011

Friday, July 29, 2011

Future of Euro's Sustainability is Vulnerable

By Grant de Graf

Although I have previously expressed a level of confidence in the Euro (See Why the Euro Will Remain Strong), reluctance by the EU to recognize its own failings and implement necessary adjustments, will ultimately result in its own eulogy.

Not affording PIIGS an opportunity to revert to their independent currencies and release them from the strict fiscal discipline of the EU, will ultimately exacerbate the challenges the EU faces and thwart free-market adjustments in the economy, necessary for a sustainable recovery.

There are several factors that are preventing EU officials from pursuing a course that will facilitate a comprehensive strategy that will ensure the survival of the Euro and economic salvation.

Although I have previously expressed a level of confidence in the Euro (See Why the Euro Will Remain Strong), reluctance by the EU to recognize its own failings and implement necessary adjustments, will ultimately result in its own eulogy.

Not affording PIIGS an opportunity to revert to their independent currencies and release them from the strict fiscal discipline of the EU, will ultimately exacerbate the challenges the EU faces and thwart free-market adjustments in the economy, necessary for a sustainable recovery.

There are several factors that are preventing EU officials from pursuing a course that will facilitate a comprehensive strategy that will ensure the survival of the Euro and economic salvation.

- Firstly, several of the pundits are constrained by a limited understanding of the dynamics and fundamentals that are at play in Europe. Common mistakes and economic conclusions are being thrust on to the conference tables of the European Parliament and consequently, the impact which a rescue plan can have on a recovery is limited, if not downright dangerous.

- Secondly, decisions that are fundamentally supportive of a recovery are being sidelined in favor of political and other self-interests.

- And thirdly, there is a perception that austerity will resolve all economic ills. Clearly, a new dispensation is required, but a recovery requires investment into those specific areas that will contribute towards rapid and sustainable growth in GDP.

Thursday, July 28, 2011

Tuesday, July 26, 2011

Monday, July 25, 2011

Saturday, July 23, 2011

Friday, July 22, 2011

Thursday, July 21, 2011

Wednesday, July 20, 2011

Tuesday, July 19, 2011

Sunday, July 17, 2011

Private Sector Participation in Greek Tragedy Crucial for Successful Outcome

by Grant de Graf

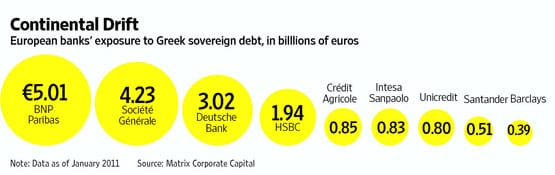

The forthcoming European summit, set to facilitate private sector participation in the Greek rescue is important. Failure to include bondholders in coordinating events, would make the bailout in essence, the provision of a rescue plan for investors, rather than a lifeline for Greece. The bailout needs funding that should be directed towards the revival of Greece's economy. It should not be a vehicle to buttress the pockets of investor's who are looking to call on a perceived surety that was provided by the ECB. In the long term this will be in the best interests of bondholders, as surely they are looking for a long term solution in which full capital can be redeemed - not a local anesthetic that provides temporary relief and doesn't deal with the cause.

The ECB's opposition to the government's plans for private-sector involvement is preposterous. Ostensibly, ECB officials fear a declaration of Greek default, even of a narrow kind, could cause a wider conflagration in financial markets. The reality is that the market has already factored in the bailout as a quasi-default. Clearly, there are other interests at play, and officials need to be weary of those at the ECB who toe this line.

Saturday, July 16, 2011

Eurozone Feeling the Stress - Inside Story

How credible are stress tests and what impact will they have on the Eurozone's economy?

Friday, July 15, 2011

PIIGS Secretly Wish to Ditch Euro

By Grant de Graf

Factors that provide a framework to a pragmatic solution to the European debt crisis.

Despite several plans to resolve the bond crisis that is sweeping Europe, a solution that deals with the fundamental causes, continues to escape policymakers. This is because key players are focused on embracing a diplomatic solution that will achieve consensus, without considering the long-term practical implications that will result from their proposals . For example, the additional funding that is being provided by the ECB for Greece's bailout, may allow the Greek treasury a brief spite of relief. However, it does nothing to set the country towards a path of growth and recovery. (See Greece: Trojans and Spartans Return to Battle) In fact the punitive austerity measures that are being imposed on PIIGS by the ECB, only serve to protract recession and make the recovery nothing more that a pipe-dream. (See Austerity vs. Stimulus: Who is Winning the Race)

Regions that are caught in the European Debt crisis on the other hand, fear financial isolation and the inability to raise capital independently, hence their outward expressions to remain loyal to the Euro and to perpetuate their membership of the Euro zone. Secretly, they carry the heavy shoulders of remorse for having even considered ditching their local currencies and converting to the Euro currency. It has invoked an era of high prices, lower standards of living, unemployment and high debt ratios.

On the other hand, core policymakers of the European Parliament interpret consent to release PIIGS from the Euro and to revert to their independent currencies, as a failure of the Euro. This is not the case.

Releasing PIIGS from the Euro is the only chance that Europe has of saving the currency and failure to provide these regions with that alternative, will be the final decree that terminates the existence of the Euro forever. Whereas agreement for troubled economies to revert to their independent currencies may be viewed as failure, it is not. It is a positive that will allow the stronger countries of Germany and France to prosper under the auspices of the Euro, while providing weaker countries an opportunity to recover. Such economic reconstruction will need to be accompanied through the privatization of public assets to reduce debt, lower taxes, in addition to government and foreign expenditure programs that can capitalize on those regions unique strengths, respectively.

Separately, there has been some discussion about the possibility of the ECB forgoing a portion of the debt that it holds over Greece. This is ludicrous. To ensure that its assets are protected, the ECB will need to provide PIIGS with credit and assistance that it requires for recovery. Interest on debt needs to be rolled over and capitalized - PIIGS has already suffered significant damage to its credibility and the fact that it cannot service debt, has been factored in by the market.

Funds need to be made available for capital expenditure programs in the regions that will impact real economic growth and not for appeasing creditors, who are looking for a payback on their investments and from economies that are inefficient and virtually bankrupt. Further, advancing funds to Greece to pay interest on its bonds serves investors, but does sweet nothing towards resolving that country's economic hiatus.

The key person who will need to orchestrate a solution is new IMF head, Ms. Christine Lagarde. She understands the importance of providing a blueprint that will be encompassing and that will not deal with issues in a piecemeal fashion, as has been the case in the past.

DSK would have said, in support of her efforts to seek a remedy. "I wish you lots of mazel."

Factors that provide a framework to a pragmatic solution to the European debt crisis.

Despite several plans to resolve the bond crisis that is sweeping Europe, a solution that deals with the fundamental causes, continues to escape policymakers. This is because key players are focused on embracing a diplomatic solution that will achieve consensus, without considering the long-term practical implications that will result from their proposals . For example, the additional funding that is being provided by the ECB for Greece's bailout, may allow the Greek treasury a brief spite of relief. However, it does nothing to set the country towards a path of growth and recovery. (See Greece: Trojans and Spartans Return to Battle) In fact the punitive austerity measures that are being imposed on PIIGS by the ECB, only serve to protract recession and make the recovery nothing more that a pipe-dream. (See Austerity vs. Stimulus: Who is Winning the Race)

Regions that are caught in the European Debt crisis on the other hand, fear financial isolation and the inability to raise capital independently, hence their outward expressions to remain loyal to the Euro and to perpetuate their membership of the Euro zone. Secretly, they carry the heavy shoulders of remorse for having even considered ditching their local currencies and converting to the Euro currency. It has invoked an era of high prices, lower standards of living, unemployment and high debt ratios.

On the other hand, core policymakers of the European Parliament interpret consent to release PIIGS from the Euro and to revert to their independent currencies, as a failure of the Euro. This is not the case.

Releasing PIIGS from the Euro is the only chance that Europe has of saving the currency and failure to provide these regions with that alternative, will be the final decree that terminates the existence of the Euro forever. Whereas agreement for troubled economies to revert to their independent currencies may be viewed as failure, it is not. It is a positive that will allow the stronger countries of Germany and France to prosper under the auspices of the Euro, while providing weaker countries an opportunity to recover. Such economic reconstruction will need to be accompanied through the privatization of public assets to reduce debt, lower taxes, in addition to government and foreign expenditure programs that can capitalize on those regions unique strengths, respectively.

Separately, there has been some discussion about the possibility of the ECB forgoing a portion of the debt that it holds over Greece. This is ludicrous. To ensure that its assets are protected, the ECB will need to provide PIIGS with credit and assistance that it requires for recovery. Interest on debt needs to be rolled over and capitalized - PIIGS has already suffered significant damage to its credibility and the fact that it cannot service debt, has been factored in by the market.

Funds need to be made available for capital expenditure programs in the regions that will impact real economic growth and not for appeasing creditors, who are looking for a payback on their investments and from economies that are inefficient and virtually bankrupt. Further, advancing funds to Greece to pay interest on its bonds serves investors, but does sweet nothing towards resolving that country's economic hiatus.

The key person who will need to orchestrate a solution is new IMF head, Ms. Christine Lagarde. She understands the importance of providing a blueprint that will be encompassing and that will not deal with issues in a piecemeal fashion, as has been the case in the past.

DSK would have said, in support of her efforts to seek a remedy. "I wish you lots of mazel."

Plan B Emerges on Debt Ceiling

McConnell Debt Plan Gets Closer Look :

Sens. Reid, McConnell Quietly Discuss Way to Keep Government From Default

Thursday, July 14, 2011

Wednesday, July 13, 2011

Monday, July 11, 2011

Despite Negative Jobs Report Data Mixed

YouTube - Paulsen Sees Improved Economic Data in August, September: "Paulsen Sees Improved Economic Data in August, Septem"

Sunday, July 10, 2011

ECB Caught in Inflation Trap

By Grant de Graf

The ECB recently increased its key interest rate by a quarter of a percent to 1.5%, in response to rising inflation which measured 2.7% for June, above the central bank's target rate of 2%. ECB President Jean Claude has indicated that he will not hesitate to hike interest rates further, to constrain inflationary pressures.

Despite higher "inflation" levels, growth rates in Europe remain constrained, unemployment is high at 9.3% and economic sentiment has plunged.

Historically, inflation has occurred in times of rapid growth and the mechanism that policymakers have used to fight the one-eyed tiger, is through monetary policy, namely interest rates. The intent of central banks in dealing with inflation through interest rates, is to curtail monetary supply, which occurs through credit expansion.

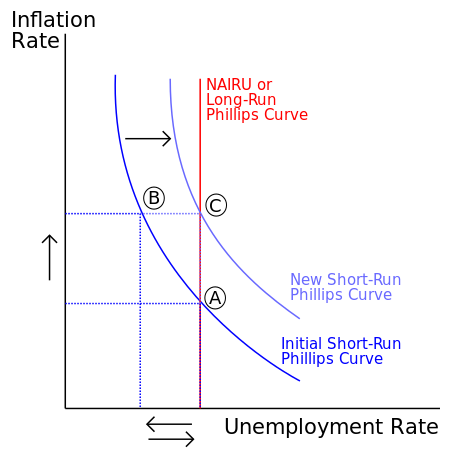

There are two main weaknesses in this approach. Firstly, there is always a question of governments being able to define and calculate inflation accurately. For example, higher inflation in the EU this year, is more likely to be a function of rising commodity prices than credit or monetary expansion. This can be substantiated by the fact that inflation is normally accompanied by a decrease in unemployment as clarified by the Phillips curve, and this has not occurred. Consequently, the EU is trying to manage an inflation problem that does not exist.

Secondly, using interest rates to control inflation runs counter to free-market theory, as setting the interest rate is subjective and randomly determined by policymakers. If the central bank gets it wrong, then they are effectively distorting the demand and supply curve for money, which could impact an economy, negatively.

Government-induced inflation (simplistically viewed as a function of printing too much money) normally occurs in periods of high growth, affording policymakers the ability to use interest rates to constrain credit expansion and slow economic activity. Europe is not experiencing a phase of high growth and therefore, increasing interest rates beyond the point of equilibrium (where the supply of money effectively meets demand), distorts the free-market adjustment mechanism within the economy that could automatically rectify an imbalance. Instead, the higher interest rates hamper efforts to facilitate growth and could plunge the EZ back into a recession.

The ECB now finds itself in a position where "inflation" is increasing, high rates of unemployment are on a rise and GDP levels are declining. Due to the negative impact that it may have on growth and levels of unemployment, using interest rates as an instrument to manage "inflationary" pressures, is no longer an option.

The ECB recently increased its key interest rate by a quarter of a percent to 1.5%, in response to rising inflation which measured 2.7% for June, above the central bank's target rate of 2%. ECB President Jean Claude has indicated that he will not hesitate to hike interest rates further, to constrain inflationary pressures.

Despite higher "inflation" levels, growth rates in Europe remain constrained, unemployment is high at 9.3% and economic sentiment has plunged.

Historically, inflation has occurred in times of rapid growth and the mechanism that policymakers have used to fight the one-eyed tiger, is through monetary policy, namely interest rates. The intent of central banks in dealing with inflation through interest rates, is to curtail monetary supply, which occurs through credit expansion.

There are two main weaknesses in this approach. Firstly, there is always a question of governments being able to define and calculate inflation accurately. For example, higher inflation in the EU this year, is more likely to be a function of rising commodity prices than credit or monetary expansion. This can be substantiated by the fact that inflation is normally accompanied by a decrease in unemployment as clarified by the Phillips curve, and this has not occurred. Consequently, the EU is trying to manage an inflation problem that does not exist.

Secondly, using interest rates to control inflation runs counter to free-market theory, as setting the interest rate is subjective and randomly determined by policymakers. If the central bank gets it wrong, then they are effectively distorting the demand and supply curve for money, which could impact an economy, negatively.

Government-induced inflation (simplistically viewed as a function of printing too much money) normally occurs in periods of high growth, affording policymakers the ability to use interest rates to constrain credit expansion and slow economic activity. Europe is not experiencing a phase of high growth and therefore, increasing interest rates beyond the point of equilibrium (where the supply of money effectively meets demand), distorts the free-market adjustment mechanism within the economy that could automatically rectify an imbalance. Instead, the higher interest rates hamper efforts to facilitate growth and could plunge the EZ back into a recession.

The ECB now finds itself in a position where "inflation" is increasing, high rates of unemployment are on a rise and GDP levels are declining. Due to the negative impact that it may have on growth and levels of unemployment, using interest rates as an instrument to manage "inflationary" pressures, is no longer an option.

Saturday, July 9, 2011

Friday, July 8, 2011

Wednesday, July 6, 2011

Tuesday, July 5, 2011

Monday, July 4, 2011

Subscribe to:

Posts (Atom)